UNDERSTANDING DAYHOME TAXES

Whether you’re new to running a dayhome or looking for ways to streamline your tax process, ADSN has the essential tips, resources, and tools you need to make tax time easier.

Below you’ll find important information on all things dayhome taxes. Know what you’re looking for?

Jump to these sections:

Understanding Dayhome Taxes

Hiring an Expert

Dayhome Guide – Chapter

Dayhome Tax Cheatsheet

Dayhome Tax Spreadsheets

Dayhome Tax Training Replays

Dayhome Tax Blog

Understanding Dayhome Taxes

As you embark on your journey of nurturing young minds in the comfort of your own home, it’s essential to understand how income taxes play a role in your business. Just like any self-employed individual (that’s you), you’re responsible for reporting the income you earn from providing childcare services. This includes the fees parents pay for your care. But fear not, for there are ways to optimize your tax obligations. By keeping track of your expenses—think supplies, utilities, and a portion of your home expenses—you can potentially reduce your taxable income. However, navigating the tax landscape can be daunting. That’s where proper record-keeping and seeking advice from tax professionals come in.

Filing Taxes as Self-Employed

Understanding the Canadian tax system as a self-employed individual is crucial for managing your finances effectively. Unlike traditional employees, you’re responsible for reporting your income and expenses accurately to the Canada Revenue Agency (CRA). When filing your taxes, you’ll use Form T2125, Statement of Business or Professional Activities, to report your dayhome income and claim eligible expenses. Deductible expenses may include supplies, utilities, rent, and a portion of your home expenses. It’s essential to keep detailed records throughout the year to support your claims and ensure compliance with tax regulations. Additionally, consider contributing to a Registered Retirement Savings Plan (RRSP) to reduce your taxable income and save for retirement. If you’re unsure about any aspect of your taxes, seeking guidance from a tax professional or utilizing resources provided by the CRA can help you navigate the process with confidence.

How Much Can You Expect to Pay?

The amount you can expect to pay in taxes varies depending on several factors, including your total income, deductible expenses, and applicable tax rates. Generally, self-employed individuals in Canada are subject to federal and provincial income taxes, as well as contributions to the Canada Pension Plan (CPP) if their net income exceeds a certain threshold. Deductible expenses, such as supplies, utilities, and a portion of home expenses, can help reduce taxable income and overall tax liabilities. It’s essential for dayhome providers to maintain accurate records and consult with tax professionals to estimate their tax obligations effectively. We recommend putting away at least 20% of your income each month to help prepare for any income taxes due at tax time.

When Do You File?

In Canada, the deadline for filing taxes is typically April 30th of each year. However, if you or your spouse or common-law partner are self-employed, you have until June 15th to file your tax return, though any taxes owed are still due by April 30th to avoid interest charges. It’s important to note that if you have a balance owing to the Canada Revenue Agency (CRA), interest starts accumulating on May 1st, regardless of the deadline for filing. It’s advisable to file your taxes well before the deadline to ensure you have enough time to gather all necessary documentation and avoid any potential penalties or interest charges.

What Should You Keep Track Of?

As a dayhome provider in Canada, keeping track of various aspects of your business is crucial for accurate tax reporting and financial management. Here are some key items you should keep records of:

Income: Maintain detailed records of all income received from parents for childcare services provided in your dayhome. If you’re with an agency, be sure to keep track of every dollar your agency sends you each month.

Expenses: Track all expenses related to operating your dayhome. This may include supplies (e.g., toys, crafts), food and snacks provided to children, utilities (e.g., electricity, water), rent or mortgage payments, insurance premiums, professional fees (e.g., accountants, lawyers), and any other costs directly associated with running your business.

Receipts and Invoices: Keep copies of receipts, invoices, and payment confirmations for all expenses incurred and income received. These documents serve as evidence to support your tax deductions and income reporting.

Mileage: If you use your vehicle for business purposes, such as transporting children to and from your dayhome or purchasing supplies, keep track of your mileage. You can claim a portion of your vehicle expenses as a deduction on your taxes.

Home Expenses: If you operate your dayhome from your residence, keep records of expenses related to your home, such as property taxes, mortgage interest, rent, utilities, and maintenance costs. You can claim a portion of these expenses as deductions based on the square footage of the area used exclusively for your dayhome.

Bank Statements and Financial Transactions: Regularly review your bank statements and keep track of all financial transactions related to your dayhome business, including deposits, withdrawals, and payments.

By diligently keeping track of these items throughout the year, you’ll be well-prepared to accurately report your income and expenses on your tax return and maximize your deductions, ultimately minimizing your tax liability.

Hiring an Expert

ADSN highly recommends dayhome providers consider hiring an accountant to navigate the complexities of tax reporting and financial management. We understand the unique challenges self-employed individuals face, especially in the childcare industry. That’s why we’ve partnered with Strategic Management Force, a trusted accounting firm specializing in small businesses and self-employed professionals. Through this partnership, dayhome providers can access expert guidance and personalized support tailored to their specific needs. Strategic Management Force can assist with tax planning and income tax filing. By entrusting your financial matters to seasoned professionals, you can focus on what you do best—providing quality care to the children in your dayhome—while gaining peace of mind knowing your financial affairs are in capable hands.

Strategic Management Force Partnership

Partner: Strategic Management Force

Service: Tax Filing for Dayhome Providers

Discount: 10% off for ADSN Members.

Location: Leduc, AB but can service province wide.

Pricing:

Personal Tax Returns (basic slips): $100 single $175 couple

Sole Proprietor $150 add’l

Bookkeeping if required $75 per hour

Making Tax Time a Breeze

ADSN has a variety of Tax Time resources that are sure to leave you feeling prepared and confident to tackle tax time!

Dayhome Guide PDF

Be sure to check out page 75 of our Dayhome Guide, where we go over Dayhome Taxes in detail.

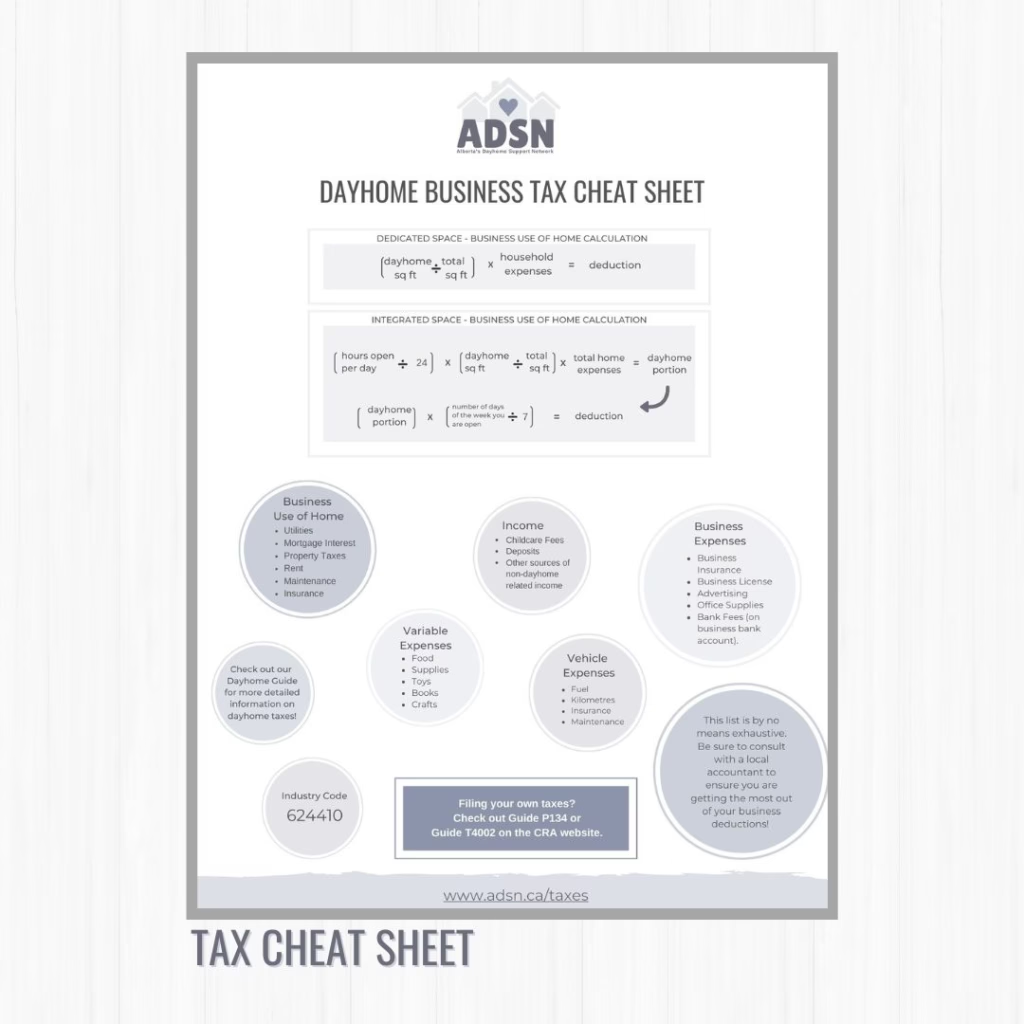

Tax Cheatsheet PDF

We’ve put together a quick one page Tax Cheatsheet that has all of the important calculations and possible deductions you’ll need at tax time.

Tax Spreadsheets - 2 Versions to Choose From

You might also like one of our Tax Spreadsheets to stay organized year-round. Easily track income, expenses, and deductions in one place. Your accountant will thank you!

Tax Training Replays - 67 Page PDF

Each year, we bring on Chartered Professional Accountant and Tax Expert Kathy Jo Matthews to teach us all about making the most out of tax time! You can catch the replays of each session inside the Learning Corner.

Tax Blog - Making Tax Time a Breeze

Our Tax Time Blog is packed with practical tips to help dayhome providers stay organized and stress-free. Discover simple strategies for tracking income and expenses, maximizing deductions, and preparing for tax season. With the right tools and guidance, you can make tax time a breeze!